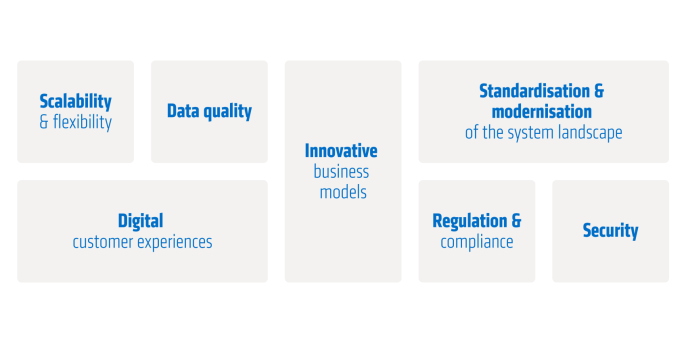

The financial sector is undergoing a transformation process that requires the implementation of far-reaching technological innovations. This results in tangible challenges and a need for action. The use of modern technologies such as data & analytics, AI or digital ecosystems forms the basis for future-proof processes and system landscapes in banking. However, without a flexible and powerful infrastructure, the challenges will become a Herculean task. With cloud computing as a key technology, the digital transformation in banking can be successfully shaped.

Opportunities and potential for banks

Cloud technology has long been more than just an IT topic. It forms the basis for new business models and organisational structures. At the same time, the use of cloud solutions also brings with it particular challenges, especially regarding regulatory requirements and ensuring compliance as well as dealing with cloud-specific risks. The transition to the cloud is therefore a decisive milestone for many banks, with the benefits and security of cloud use taking centre stage.

The advantages are obvious: cloud computing offers flexibility, reliability, cost and process efficiency, room for innovation and scalability. It enables banks to organise their infrastructure flexibly and react quickly to new market requirements and customer wishes. At the same time, it guarantees a high level of data security and effective protection of personal data. This makes the cloud the central driver for a modern and sustainable organisation of banking value creation.