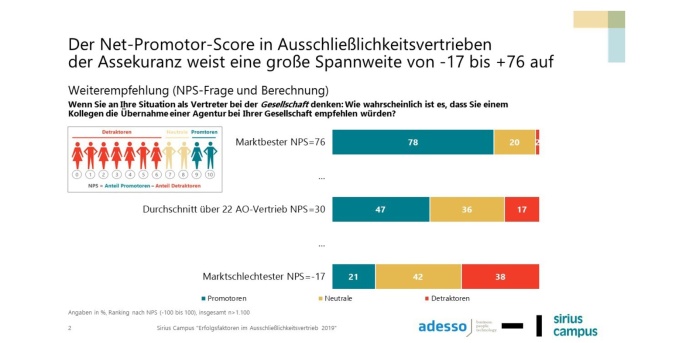

The 22 sales agents achieved an average net promoter score (NPS) of 30 (47 % promoters minus 17 % detractors). Market leaders even achieved an NPS of 76. These are the results revealed by the current benchmark survey from Sirius Campus in cooperation with IT service provider adesso. The first part of the survey was already presented to the public in October (on digitalisation in insurance agencies).

As part of the “Success Factors in Exclusivity” benchmark survey series carried out since 2003, more than 1,100 insurance agents for 22 insurers were interviewed by telephone between May and July 2019. The survey, which aimed to assess cooperation between agencies and their insurance companies, is carried out in cooperation with the IT service provider adesso, which has been supporting leading insurance companies on the path to digitalisation for over two dec-ades.